Reimagining Finance for a Better World: How Regenerative Finance (ReFi) is Leading the Way

May 2023

Traditional finance (TradFi) has generated enormous amounts of wealth and prosperity (at least for some) since the dawn of the Industrial Revolution. However, what is often left out of consideration is the less tangible and ancillary costs of all that generated wealth and societal development. A new financial movement has been growing over the past decade that takes into account living systems, communities, and the environment. After all, all wealth that exists only does so thanks to the Earth and its abundant resources.

The name of this new system? Regenerative Finance.

Capital has given us the modern industrialized society we all benefit from every day. However, it can be a two-edged sword. Much of the ills society and our diminishingly-habitable environment suffer are due to the business-as-usual financial system. The good news is that rather than throwing the baby out with the bathwater, capital can be used as a dynamic and purpose-driven tool that improves social and ecological systems. By its very nature, regenerative finance (ReFi) can shift society from being degenerative, skip over being sustainable at unsustainable levels, and jump straight into being regenerative.

What Is Regenerative Finance?

“A Regenerative Economy maintains reliable inputs and healthy outputs by not exhausting critical inputs or harming other parts of the broader societal and environmental systems upon which it depends.”

-John Fullerton

The societal systems we have collectively developed in the industrial age cannot be fixed using simple solutions. This is why regardless of the solutions put forward by think tanks, governments, scientists, and others, we are still seeing continuous degradation and disintegration across the board, especially when it comes to the massive financial disparities between peoples around the world, the environment, and culture clashes. It is all connected to our modern civilization having its very foundation built upon a financial system that takes more than can be replenished.

If we look to the natural world, we see that the exact opposite. While we have seen efforts taken by corporations and governments in recent years designed to mitigate the damaging effects of industrialization and modern society, these are often not enough, or are coming at problems in a way that is not solving the complex issues and actually creating new problems. You can think of it similar to how a treatment for a condition can end up causing several new side effects that themselves require treatment.

Sustainability was the buzzword use for the early past of the 21st century as a way to address the problems, often environmental ones, facing society. However, this led to issues like greenwashing and deflection of corporate social responsibility to consumers for applying sustainable practices in their personal lives.

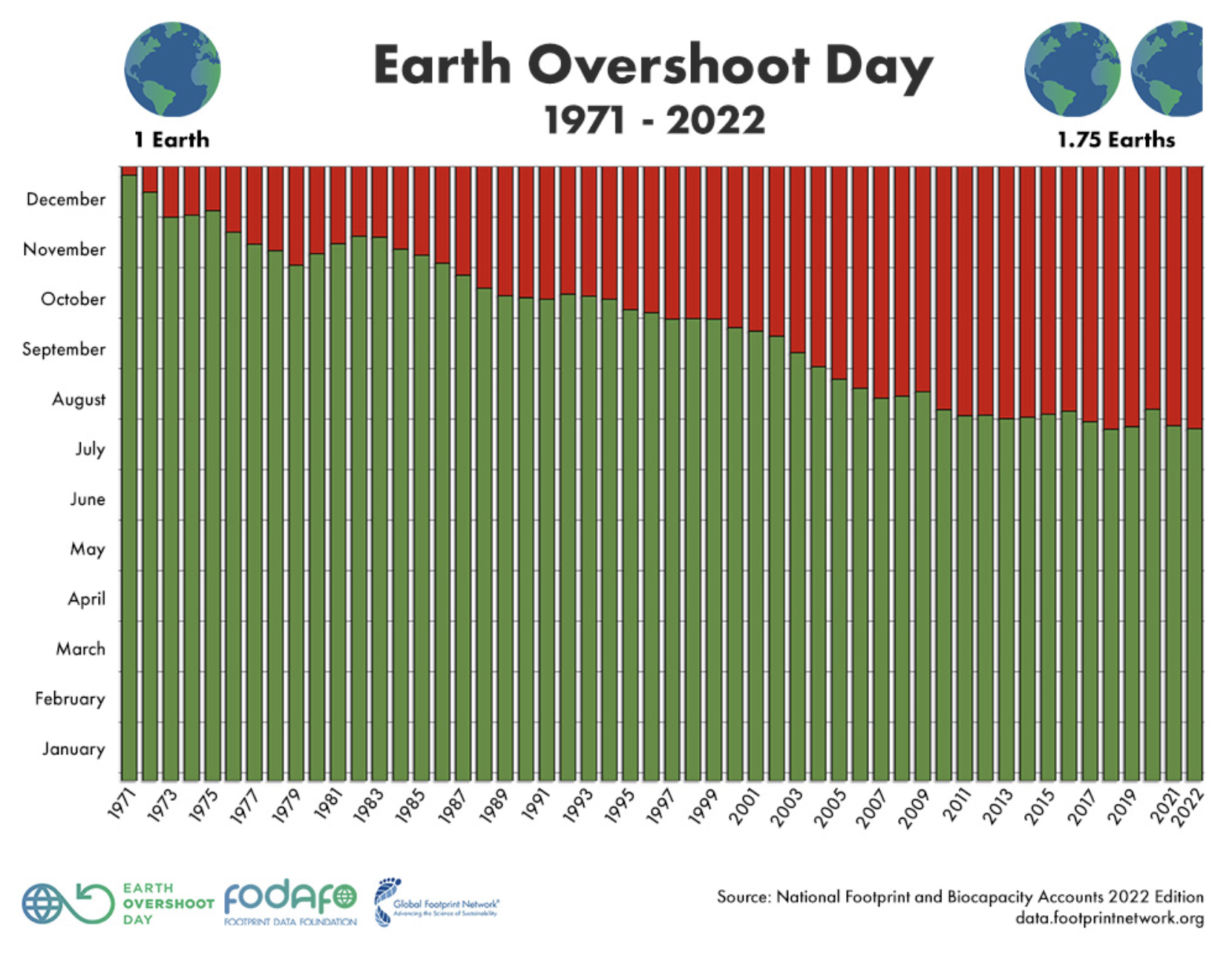

The biggest issue, however, was the fact that the current rate of resource consumption is not sustainable, and has not been for a long time. This is especially true when we consider resources that do not replenish anytime soon, such as rare earth metals. The point within a year where society has consumed more resources than have been regenerated by the environment is called Earth Overshoot Day. Taking the Earth as a whole, this day was July 28th in 2022. Once the year is over, society will have used up 1.75 Earths worth of resources.

As we can see, over the past decade the overall overconsumption of resources has indeed been looking a bit more “sustainable” but we are still collectively consuming 75% more resources annually than are being regenerated. Sustainability practices will not prevent catastrophe...they will only slightly delay it.

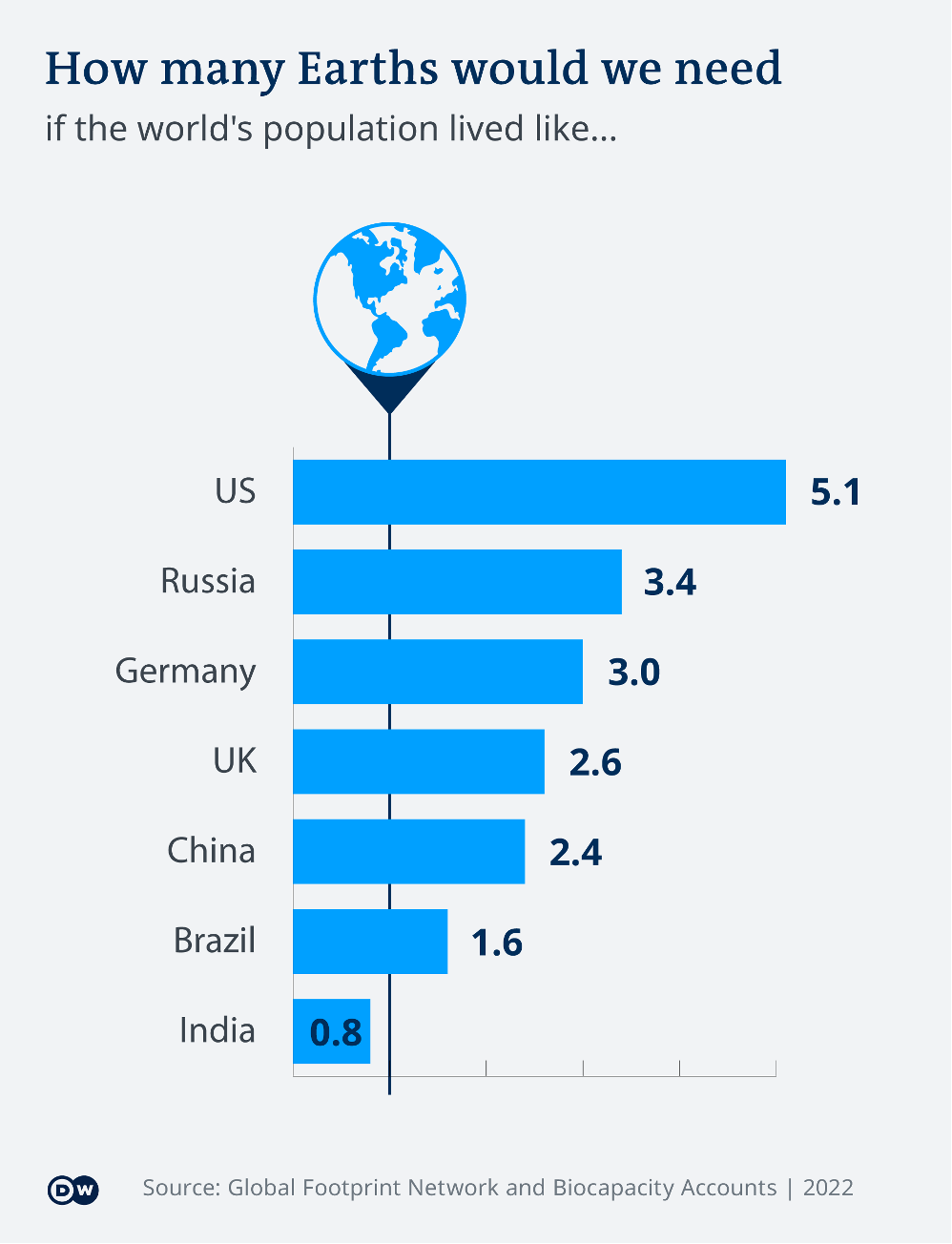

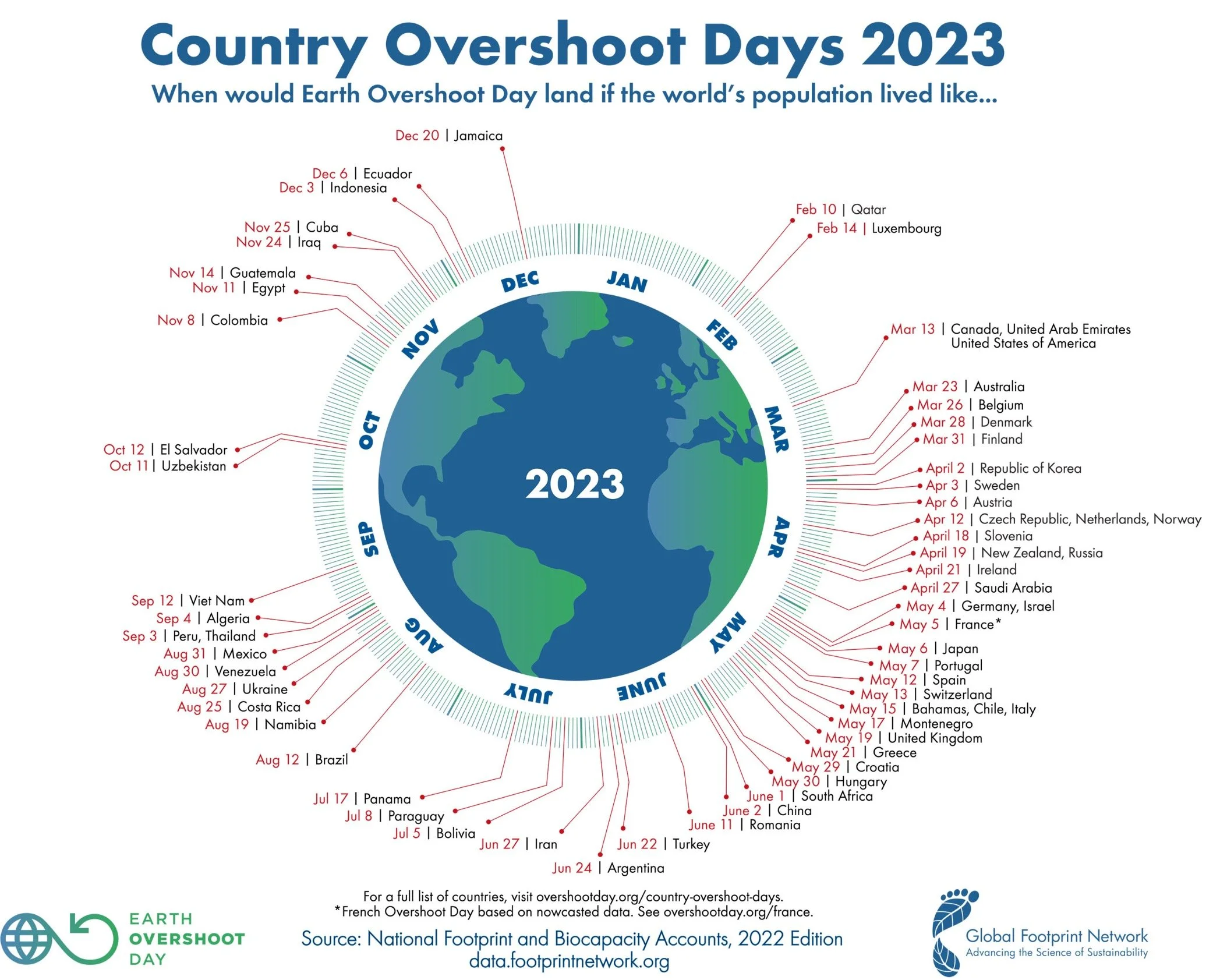

Some countries are consuming an extreme amount of resources to the point where over five Earths would be needed for those nations to live sustainably, as is the case with the United States.

Thankfully, not all countries are over-consuming. There are 51 nations that never reach an overshoot date. Society was, as a whole prior to the 1970s, living in a way where resources were regenerating faster than they are being consumed.

What does all of this have to do with regenerative finance? Well, we simply cannot fix the problems facing society today, in all aspects, as long as a flawed financial system is in place.

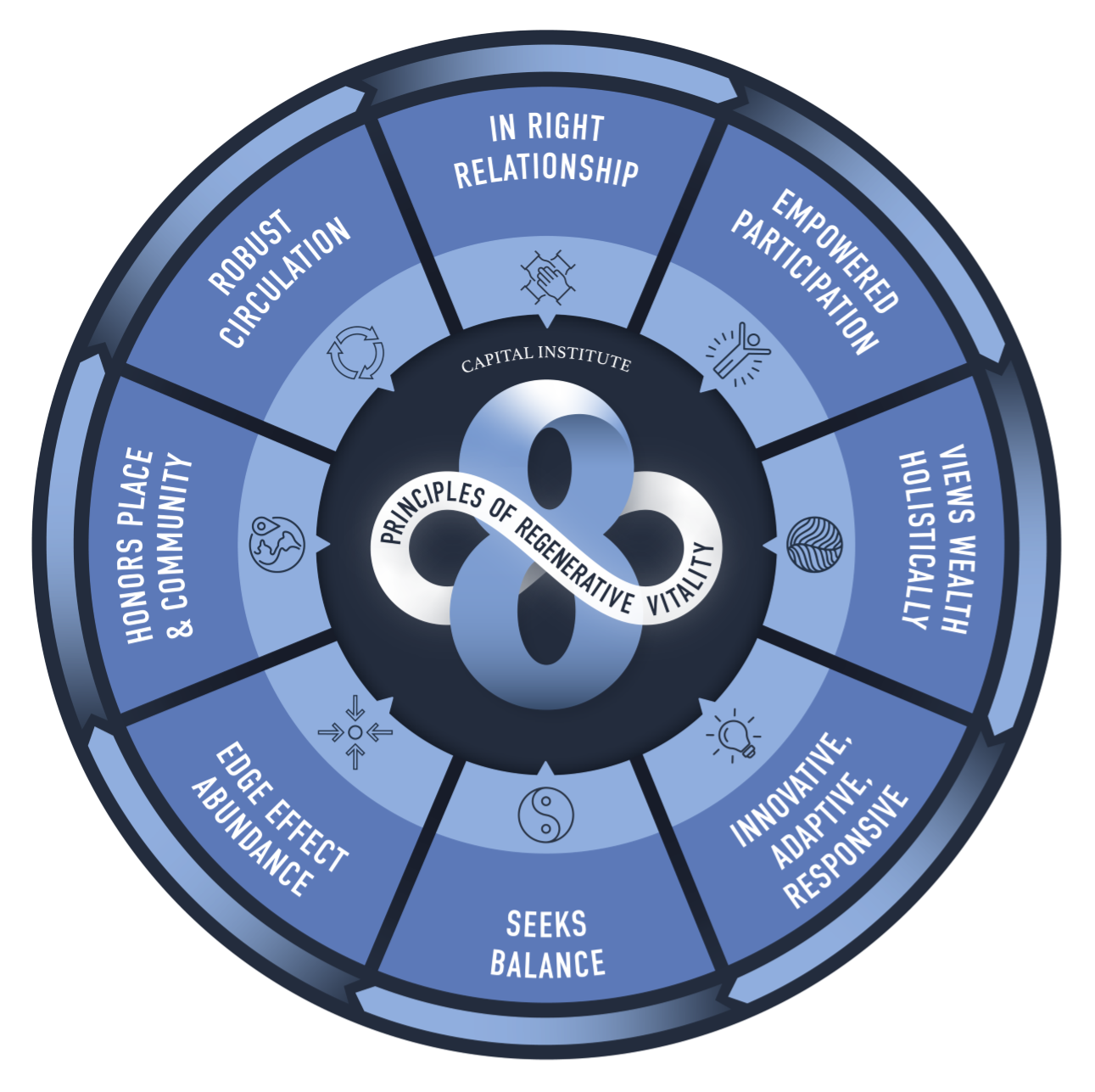

Ever since the concept of regenerative economics was first presented by economist John Fullerton in 2015, there has been an upswell in interest over applying regenerative principles to finance. This is part of a larger regenerative movement that has taken other areas of society by storm in recent years, including agriculture and architecture design. What started out as a concept promoted by impact investors and forward-thinking economists has now become an essential strategy if both the public and private sectors want to see their people and profits thrive and prosper well into the future.

It should also be understood that regenerative finance is not attempting completely disregard everything the modern capitalist system has provided society, because it has helped advance society in many ways. Instead, ReFi sees the need for it to evolve to its next stage before it is too late. Reconfiguring the current economic system from being extractive to regenerative is the focus. This will reply on all stakeholders working together collaboratively to restore and preserve the dwindling resources we have on Earth today. It is completely illogical to assume that society will not experience extreme levels of unrest, poverty, and starvation if trends such as 50% of all marine life having disappeared in the past 40 years continue.

Regenerative finance leverages money as a tool for solving systemic issues, as well as community and environmental problems. It uses decentralized finance (DeFi) and blockchain technology to assist in reversing the damaging effects of industrialization, along with systemic financial imbalances. Web3 technologies could be leveraged to support the improvement of ecological and social issues, be it deforestation, food scarcity, or something else. ReFi actively encourages investment in regenerative projects, which then leads to the regenerative movement spreading globally until a critical tipping point is reached. Everything in a public blockchain is recorded in a transparent way, ensuring all contributions are being tracked for all to see how impactful those investments truly are. This allows for accountability for companies to be honest with how “green” their regenerative initiatives truly are. It also enables private individuals to verify a firm’s claims, thereby leading to authentic behavioral change that does away with greenwashing.

The overall goal is to shift the global economy from being degenerative or sustainable to being regenerative so that shared value can be created. Part of this shift involves shifting from endless accumulation and throwaway culture to a circular economy.

“Circular economy not only is good for us, but is also financially very strong to generate competitive advantage.

-Mark Esposito, Teaching Faculty on Business, Society & Government, Harvard University

This sort of economic model will actually benefit businesses given they will be taking advantage of materials in products by reusing them for new products rather than seeing them going to landfills. For example, a large majority of the 300M tons of plastic waste produced yearly by industry could instead be used, after some processing, for new products like clothing and building materials.

“Through remanufacturing we are able to reduce the cost of doing business, because we are able to give the customers components at a fraction of what it would cost to get a new one.

-Lesibana Ledwaba, Executive Director for Operational Transformation and Strategy, Barloworld Equipment

The financial incentive to reuse raw materials comes at the lower cost of producing new products that are made from raw materials that have a previous life as a different product. By reducing costs for businesses and allowing natural resources to regenerative more, we get to enjoy a win-win for profits and people.

Three Premises of Regenerative Finance

Overall, there are three premises when it comes to ReFi:

The human-created economy is a living system (but one in gravely poor condition right now)

There are identifiable universal patterns and principles that explain of how human society operates.

Designing an economy in coherence with those patterns and principles that takes living systems into account will result in long-term thriving and prosperity of all stakeholders.

Why ReFi Matters

Traditional finance approaches the very dire problems facing civilization as we know it too myopically. A milquetoast strategy is not enough anymore, nor has it ever been. There are systemic failures occurring across all sectors of society, and the easiest way to have somewhat of a smooth transition is to transition to a regenerative financial system.

There is a promising trend of environmental, social, and governance (ESG) factors in the investment world. Unfortunately, the focus is still too much on reducing detrimental impacts rather than achieving positive impacts. Even when investing is concentrated on making a positive net impact, it focuses too narrowly when it defines its targets. Additionally, what is often not taken into account is how an outcome is created and what stakeholders are the ones benefiting. The finance industry, including banks and lenders, is largely ignoring its impact on the environment. Grant-making and foundations also are sometimes missing the mark when it comes to supporting development and access to innovative and meaningful solutions.

This is where regenerative finance can shine.

ReFi integrates a wide array of capital and provides social enterprises, projects spearheaded by local communities, and restorative environmental projects with the financing they need to resolve the problems the world faces. When these innovative initiatives maximize success, they also can maximize long-term profits in a way that leaves more for the many generations that can come after us.

When as many interconnected and interrelated causes and effects are diagramed and mapped out, capital can be deployed more fairly. Overbearing repayment terms and collateral requirements extracting vital resources from communities can be replaced, and exclusionary credit standards can be revised. Principal stakeholders are invited to be a part of the decision-making process.

How ReFi Is Leveraging Decentralized Blockchain Technology

There is a strong and close relationship between ReFi and decentralized systems. Since the goal of regenerative finance is to leverage emerging technologies to adequately incentivize coordination of environment-improving technologies and policies, blockchain technology is seen as a great tool in this endeavor.

New forms of capital, such as cryptocurrencies, tokenized digital assets (NFTs), and more can be used to implement uniform standards and metrics that are vital to ensuring meaningful and positive changes are made on both corporate and government levels when addressing the challenges facing society.

Climate is a major focus for investment today but regenerative finance practices also need to take into account pollution, waste, toxic industrial agriculture, and many other aspects of the total system humans are a part of and contributing to. Any touchpoint we have with the natural world from which every single resource we use in our industrialized civilization emerges from needs to be identified and studied. Only by taking this kind of whole systems approach can we enact meaningful positive and long-term changes.

Thanks to being a decentralized immutable ledger, a blockchain can also record and verify the impact an initiative is making. When there is uniformity in results, a ReFi-minded team could then move onto the next step: developing financial products and tools that produce long-term regenerative returns benefiting all stakeholders. By moving in this direction, we will see the rise of tokenized ReFi assets that could even become major stores of value in areas such as climate finance.

ReFi Examples

Decentralized systems are likely to be the foundation of regenerative finance. Some of the potential platforms taking center stage currently are ones involved with assessing climate risk, standardization, and carbon asset trading, such as:

Climate oracles

Climate risk pricing markets

Real-time sequestration data

Tokenizes coal plant retirements

Real-time sequestration liquidity

Regenerative agriculture has been a model example of regenerative finance in action. This is because it takes into account all elements within the farm and food system, and ensures they are working harmoniously while perpetually replenishing natural resources and improving human health. It goes far beyond just minimizing water use, removing harmful pesticide application, or improving soil health. Instead, it integrates all of these strategies and many more. Organizations like Funders for Regenerative Agriculture and RSF Social Finance are trailblazers when it comes to combining ReFi with ReAg.

Hopefully, additional initiatives that can provide meaningful improvements will receive much-needed capital investment, such as nature-based regenerative solutions to climate-related issues that achieve the sought-after results but without the harmful side effects experimental technologies pose a threat to unleashing, such as solar geoengineering.

Conclusion

The entirety of human civilization is at a choice point where it can continue making small and largely insignificant changes while the environment, and all societal aspects connected to it (including the economy), continue to become increasingly turbulent and chaotic, or take the courageous and bold leap into a regenerative system where the brunt of societal ills can be remediated.

Regenerative finance is the key waiting to be used because it effectively applies systemic solutions to systemic problems. Blockchain technology is a helpful tool in leveraging ReFi to its full potential. All that is left now is the desire to make meaningful change and benefit from the financial, social, and environmental success that will follow.

Are you interested in learning more about regenerative finance and how your organization or business can benefit from and apply it? Contact us today and we will be happy to continue the conversation with you.

About the Author

Paul Lenda is a Digital Advisor at Pacific Advisory. He has a decade of experience working and operating within the blockchain industry, and advises on the responsible use of emerging & digital technologies, as well as adoption of regenerative systems, in a way that leverages benefits, reduces risks, and optimizes processes, resulting in improved socio-economic models.