DeFi Innovation: Exploring New Financial Models for Businesses and Entrepreneurs

June 2023

The failure of several massive centralized intermediaries within the blockchain and cryptocurrency industry in 2022 shined a light on the fact that there are inherent flaws within CeFi that DeFi is not prone to.

While there are shortcomings within both Centralized Finance (CeFi) and Decentralized Finance (DeFi), major collapses like FTX, Terra/Luna, Three Arrows Capital, BlockFi, Celcius, and Voyager provide enough compelling evidence that centralization is inherently risky. In fact, it’s safe to say that the major issues cryptocurrency markets have faced has been due to failures of centralization.

Satoshi Nakamoto’s DeFi Vision

“DeFi is indeed a safer option than CeFi, thanks to the inherent features of the latter, including systemic transparency, over-collateralized lending, and automated liquidation of borrowers. We need to understand the point that DeFi is still an evolving concept, and with greater adoption, it will become safer and accessible to the masses,”

Sumit Ghosh, CEO and co-founder of Chingari.

The modern cryptocurrency and blockchain industry would not exist had it not been for Satoshi Nakamoto (a pseudonym) creating Bitcoin on the heels of the last global financial crisis in the late 2000s.

Bitcoin’s whitepaper unveiled a novel decentralized digital currency payment solution whose purpose was to resolve the inherent flaws within the traditional banking system. Within CeFi, everything is governed by central authorities who can block anyone access to their own money whenever they want to. Even worse than that, there is no government insurance for assets on centralized exchanges or other similar CeFi institutions.

With decentralized finance, instead of a centralized exchange, smarts contract fulfill the role as the intermediary and executor of financial transactions and activities. A smart contract executing on an immutable distributed ledger (blockchain), ensures everything is transparent, safe, and tamper-proof.

At its heart, DeFi is a blockchain-based way of conducting financial activities that is not reliant on centralized financial intermediaries. We can take this further to mean that there will be no mixing of your funds with some financial institution’s funds for use in risky investment ventures, as is all too often the case in banking system. In fact, 2023 is shaping up to be a year of massive bank failures, with several banks in the US and abroad having collapsed already. Why? Because they were getting into the habit of taking user funds and investing them, often at a loss.

How DeFi Works to Transform Financial Models

Courtesy of Chainlink

If you have heard of DeFi before, you may only understand its surface-level meaning of broadening financial inclusion, facilitating open access, and encouraging permissionless innovation. However, the importance of how DeFi works to transform the financial system itself cannot be emphasized enough. The world of DeFi presents many opportunities for entrepreneurs looking to unlock greater success. One of its biggest appeals, especially for SMEs, is that it removes most of the barriers to entry into financial markets.

We will go over DeFi’s potential uses and advantages for businesses and entrepreneurs, demystifying what this term means in more specific terms. You may identify one or more ways in which DeFi could become instrumental for improving and optimizing how you conduct business.

DeFi Saves Time & Money

A whole new world of possibilities opens up thanks to peer-to-peer payments. Costly and time-consuming cross-border payments are no longer necessary or a burden for both sender and recipient. The instant and low-cost nature of DeFi transactions is a major reason why it is scalable, particularly for institutional investors.

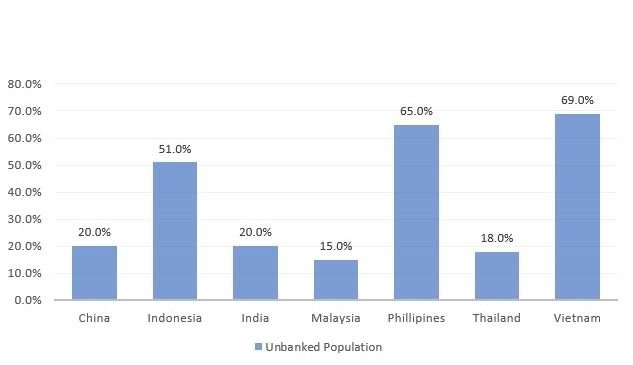

DeFi Banks the Unbanked

There are nearly two billion adults around the world without bank accounts in traditional financial institutions or mobile money providers. In fact, the Asia-Pacific region houses the majority of the world’s unbanked. while the Pacific Islands have some of the highest levels of unbanked and underbanked peoples in the entire world.

Decentralized finance has already reshaped the modern financial system, and is helping create a new landscape for entrepreneurship and innovation. By removing intermediaries, the unbanked finally have financial services available to them en masse. It’s no wonder in countries like Ukraine, Argentina, Lebanon, Venezuela, Nigeria, and Pakistan where fiat currencies are becoming significantly devalued, or there is major political instability, have seen widespread DeFi adoption recently.

Not only are the unbanked and underbanked gaining access to helpful financial services and stable digital currencies, but entrepreneurs and SMEs are tapping into an expanded market share that was not possible just a 5 years ago.

DeFi Uses For Businesses & Entrepreneurs

Let’s get more specific regarding how DeFi works and the various DeFi uses for businesses and entrepreneurs. Depending on your industry or goal, some of these may be more relevant than others. You will likely find at least one DeFi use-case that can be leveraged by your company.

Fundraising and Tokenization

Tokenization (and the fundraising that can come from it) refers to when a digital token is created on a blockchain network. These tokens can represent any form of value and have whatever utility an individual or group decides to tether to it. Entrepreneurs and businesses can either create a new cryptocurrency and provide utility to it or take existing real-world assets and tokenize them.

Tokenization allows for fractional ownership, which lets businesses divvy up assets into smaller units that are represented as digital tokens, be they ERC-20, ERC-721, or ERC-1155 tokens. An ERC-20 token is a cryptocurrency token while ERC-721 and ERC-1155 tokens are Non-Fungible Tokens (NFTs). NFTs are usually indivisible but in recent years fractional NFTs have begun being possible as well.

When it comes to alternative fundraising avenues beyond traditional venture capital or bank loans, cryptocurrency tokens can be launched. These can be initially released on decentralized exchanges (DEXs) when paired with another coin, such as the blockchain’s native coin (ETH for Ethereum), and with enough promotion, you may get people to invest in your project.

A more risk-averse approach is by initially releasing a token on an Initial Dex Offering (IDO) launchpad like DAO Maker and raise funds from everyday “retail” investors. When proper tokenomics (which Pacific Advisory can assist with developing) are established, a long-term sustainable model can be set up while receiving funding more easily.

Lending & Borrowing

Traditional financial institutions are not that excited about decentralized finance. Why is that? It part it has to do with the fact that blockchain-based DeFi simply offers more to borrowers.

Those entrepreneurs or SMEs that would not normally qualify for a loan from a traditional financial institution suddenly have access to funds from one or multiple investors directly, and right away. DeFi loans are always defined and monitored by specially-programmed smart contracts. Differing from traditional bank loans, there are no requirements for shoring up collateral.

DeFi lending platforms like dYdX, Aave, Compound, MakerDAO, and Yearn Finance offer borrowing and lending using smart contracts to facilitate transactions. This enables these platforms to operate in a decentralized and trustless manner.

Lenders get to enjoy attractive and sustainable return rates while borrowers receive predictable loan terms without needing to put up collateral. Without transparency and a trustless system, this simply would not be possible, hence why in TradFi it is nearly unheard of.

Business Without Borders

DeFi can provide access to global markets by removing geographical barriers that cause friction in TradFi. Businesses can access a global pool of investors when they delve into decentralized finance, often through either investing in various DeFi programs that exist or creating fundraising through token offerings, as mentioned previously.

Businesses can attract investors from all over the world, which helps expand their investor base and tap into new sources of capital. Startups and small businesses may find this especially helpful due to them often struggling to access traditional funding channels.

As clearer and more helpful cryptocurrency regulation begins to rollout across the world, like it is currently doing in Hong Kong on June 1st, the ability for people to safely leverage the benefits of DeFi are growing as time goes on, which helps provide more financial opportunities for individuals and businesses alike.

Enhance Transparency & Trust

Decentralized finance using blockchain technology allows for a transparent and immutable record of transactions. If a business is looking to show its clients or customers that it is doing what it says, without any black boxes obfuscating anything, leveraging DeFi will make that possible.

Ownership and transactional information is securely recorded and publicly verifiable on block explorers like Ethersan. This degree of transparency builds trust among stakeholders, reduces the risk of fraud, and enhancing the credibility of a business.

Improve Efficiency & Reduce Costs

On-chain business transactions can help with streamlining when it comes to eliminating intermediaries, reducing administrative burdens, minimizing paperwork, and slashing certain business expenses like international remittance fees.

Smart contracts on distributed ledgers can automate compliance, distribution of funds, and other functions. This can help with enhancing operational efficiency and reducing the need for intermediaries.

Yield Farming & Liquidity Mining

Yield farming and liquidity mining are very closely related and are terms that are sometimes used interchangeably. Essentially, these involve providing liquidity to DeFi platforms and protocols. In return, token-based or fee-based rewards from the protocol are earned according to a (generally) variable APR or APY.

What you are doing is lending or staking cryptocurrencies on a platform like Lido to provide liquidity for various purposes, like facilitating trading, lending, or borrowing. In the case of Lido, you are going to stake a blockchain’s Proof-of-Stake coin (ETH in this example) in order to help secure the network. In return, you receive some ETH as a sort of ‘Thank you’ for helping keep the network secure.

Yield farming has the opportunity to provide the following benefits:

High yield opportunities that are significantly higher than TradFi investment options.

Token rewards that may have potential future value if the protocol is popular.

Risk diversification of cryptocurrency holdings by allocating funds to various protocols.

While yield farming certainly houses benefits, it also carries risk. It is prudent to understand the risks when getting involved in yield farming within the context of DeFi uses for businesses and entrepreneurs.

The following are risks you should always consider prior to getting involved in any yield farming:

Impermanent Loss - IL is when the value of deposited assets changes compared to holding them directly. For instance, if the price of deposited assets diverges significantly during a yield farming period, you may incur losses when withdrawing funds.

Smart Contract Vulnerabilities - Everything blockchain-based involves interacting with smart contracts. These software programs govern DeFi protocols and are excellent when they are free and clear of any code issues. However, they are susceptible to bugs, vulnerabilities and even malicious attacks, which can result in a loss of funds.

Volatility - The cryptocurrency market is highly volatile and speculative. This could mean the value of rewards or deposited assets can fluctuate significantly unless the assets are stablecoins pegged to a major fiat currency like the US dollar. Entrepreneurs and businesses should be prepared for price volatility.

Platform Risks - To partake in yield farming you must choose and trust a decentralized platform. There is a risk of the platform you choose either failing, being a scam, or getting hacked. This could lead to a loss of funds. Thoroughly vet a platform and check if it has a long and solid history and that its contracts have been audited.

As long as you understand the risks and do your research, you should be able to avoid any major issues and leverage the benefits of DeFi. Remember, the higher the APRs and APYs, the higher the risk. This is why most people in DeFi choose to go the low-risk route and earn 5-10% APR on trusted and well-established platforms..

To summarize a list of best practices:

Conduct thorough research and due diligence.

Manage risk through diversification and careful investment strategies.

Stay informed about new DeFi projects and industry trends.

Engage with the DeFi community and learn from experiences participants.

Conclusion

Decentralized Finance is a whole new world of opportunity for solo entrepreneurs and SMEs. In today’s digital age, it is essential to innovate and adapt, as well as leverage emerging technologies like blockchain. Exploring DeFi opportunities for fundraising, optimization, cost reduction, and more can yield significant benefits. If you want to stay ahead of the curve, explore the new financial models DeFi is producing.

If you would like to learn more about DeFi and how it can benefit your business, contact us today.

About the Author

Paul Lenda is a Digital Advisor at Pacific Advisory. He has a decade of experience working and operating within the blockchain industry, and advises on the responsible use of emerging & digital technologies, as well as adoption of regenerative systems, in a way that leverages benefits, reduces risks, and optimizes processes, resulting in improved socio-economic models.