From Fiji to Kenya: The Rise of Mobile Money Transfers and What It Means for the Future

April 2023

Vodafone and Digicel – these are the two largest mobile phone service providers in the Pacific, and they are transforming the way money is moved and used by people in the region.

Digital transfers (and more specifically mobile money transfers), have seen explosive growth across the world, from Kenya to Fiji. We'll explain why and what it means for the future of finance and connectivity in the South Pacific.

What Are Mobile Money Transfers

Before we get ahead of ourselves it is a good idea to understand exactly what are mobile money transfers. If you have never done one before, it is a simple concept to understand.

Let's put it this way. Are you tired of waiting in long lines at the bank, only to find out that the transfer you wanted to make is not possible? Are you done with worrying about carrying cash with you everywhere you go? Is there someone you want to send money to but they live in a remote location and cannot get to a bank easily? Mobile money transfers offer themselves as a solution to these and other financial friction points.

In many ways, the apps that are often used for mobile payments in various developing nations like Fiji and Kenya are comparable to send-your-friends-money apps like Venmo. However, since Venmo requires you to be linked a bank account or credit card, anyone without one of these is unable to use it.

Mobile money accounts can be used without the need for a bank account. These digital payment systems use human agents (people who hang out at key spots across a country, including isolated rural areas) with cash and a telephone to make a deposit or collect cash from the app. Mobile money transfer systems can be used for other cashless transactions, such as paying for services or groceries.

When you approach an agent, you can deposit cash into your mobile money account or withdraw cash by transferring funds from your account. Agents operate similarly to ATMs. When it comes to having access to cash when you need it, as well as a secure place to deposit it when you don't, agents offer a significant advancement in countries where few people have a bank account or easy access to a bank branch.

Digital transfers are becoming increasingly common as the world goes more digital. They make it possible to effortlessly send money without using cash or going to the bank, using only your cell phone.

Those living on Pacific islands who are often separated by great distances from access to conventional banking services, or people who might find it challenging to travel a great distance to the closest bank branch, find mobile money transfers to be especially helpful.

Mobile money transfers are not only secure and safe but incredibly convenient. In addition to offering additional security features like PIN codes or biometric authentication, several companies encrypt transactions. Mobile money transfers can also help small businesses run more smoothly due to being able to send money instantly.

The Rise of Digital Money Transfers

The Pacific region has one of the lowest internet penetration rates in the whole world.

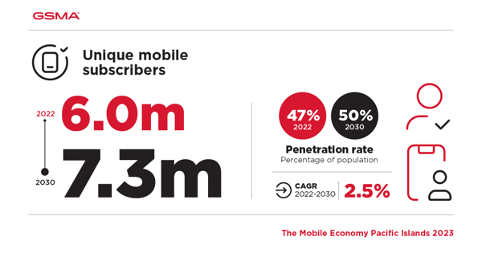

Mobile internet is at a lowly 27%, far below most of the world, and it is only expected to grow to 31% as of right now. When it comes to mobile subscribers in general, the numbers are a little better, as seen below.

Compare this 47% with 2018's numbers, when just 38% of the Pacific Islands population had mobile service, and you can see there is promising progress being made.

According to information gathered by GSMA Intelligence, there is a connectivity gap in the Pacific that might prevent millions of people from having access to mobile data. Thankfully, a recent rise in 4G connections is leading to an increase in connectivity and the benefits that come with it, such as mobile money transfers.

Additionally, satellite service growth and submarine cable build-outs have improved the region's worldwide connection in recent years. More underwater cables are expected to be completed in the next few years, leading to even more improvements in connectivity.

Fiji: A Rising Pacific Star for Digital Payments

Due to its advanced economy and high rates of mobile and internet penetration, Vanuatu's neighbor to the East, has seen some very impressive growth when it comes to using digital payments services.

The success in getting Fijians to go digital with their payments lies in two mobile money transfer systems: Vodafone's M-PAiSA and Digicel's MyCash.

It's quite simple how these systems work. You simply place money onto your Vodafone or Digicel serviced mobile or redeem money from it at select banks.

The Fiji Times has just reported that as many as 632,123 people (over two-thirds of the nation's population) utilized either M-PAiSA or MyCash for mobile money services in 2022, P2P transfers being the real shining star.

Vodafone Fiji and Digicel Fiji mobile money transfers continued to skyrocket in growth. According to the Reserve Bank of Fiji's latest report, "The total value of electronic money (e-money) in circulation rose by 53.6 per cent to $83.6m at the end of July 2022."

But that's not all. “During the year, the value of person-to-person (P2P) transfers increased by 341.7 per cent to $782.4m on the back of a notable increase in the number of P2P transfers by 316.5 per cent to 12 million transactions.

These remarkable increases in P2P transfers using digital payment systems in Fiji show just how popular it is becoming to go digital when sending money. If these are the results we are seeing in Fiji, we can extrapolate out into the rest of the Pacific region and surmise that we will see similar success elsewhere in countries like Vanuatu and beyond if these services are actively promoted, encouraged, and incentivized.

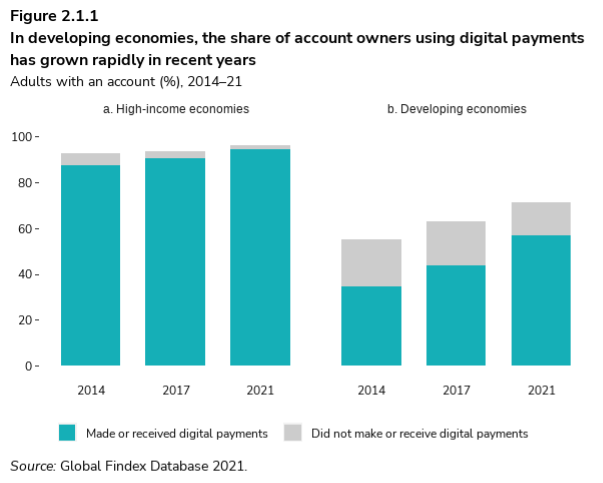

The convenience and accessibility to money that mobile money transfers provide can do wonders for a segment of the global population that has historically lagged when it comes to ease of financial access, as well as mobile connectivity. Reducing the connectivity gap will make it much easier for people in the Pacific to participate in the digital economy and take advantages of the numerous opportunities going digital offers. Increased connectivity will lead to an increase in the use of digital payment systems like mobile money services like we have been seeing in Africa.

Kenya's Embrace of Mobile Money Transfers

Speaking of Africa, it is good to understand what is happening in Kenya when it comes to mobile money systems, because it is another emerging market that shows parallels to what is currently happening in Fiji, with even greater success.

While Fiji has M-PAiSA, Kenya has M-PESA. More specifically, M-PESA is the biggest fintech platform in Africa and the most popular mobile money service on the continent. Due to its security and unrivaled convenience, M-PESA is the favored method of payment across Africa for both banked and unbanked individuals.

Millions of people own mobile phones in Africa but do not have bank accounts, or simply have restricted access to banking services. Thanks to digital payment systems like M-PESA (and cryptocurrency which has skyrocketed in popularity in Africa recently), they can also send and receive money quickly and easily.

Currently, M-PESA is helping over 51 million users in seven African countries benefit from a cost-effective, safe, and convenient method to send and receive money, top up airtime, pay bills, get paid, acquire short-term loans, and more. Kenya has been one of the great success stories we can turn to study when it comes to this mobile money transfer system.

Kenya's M-PESA Success Story

M-PESA was established in Kenya in 2007 by the Vodafone Group and Safaricom. At the time, it was virtually the only way millions of people were able to access financial services. The "M" stands for mobile, and "Pesa" is the Swahili word for money.

“As the original mobile money service, M-PESA has been the most significant driver of financial inclusion in Africa over the past 15 years. It is the continent’s largest fintech platform and provides access to financial services for more than 50m people – in a secure, affordable, and convenient way. M-Pesa is a great example of how a regional platform can evolve and grow to meet and anticipate customer needs using smartphone technology – from peer-to-peer money transfer, to payment of utility bills, to enabling the payroll of businesses, and to financial services such as micro-loans.”

-Nick Read, Chief Executive Officer of Vodafone Group

It turns out that this easy-to-use digital payment system, originally based on SMS without the need for a smartphone or app, has been making a major difference for unbanked and underbanked families. In fact, it has even helped reduce poverty.

A study with its findings released in 2016 uncovered that families living nearby a mobile money agent shifted away from living in extreme poverty (less than $1.25/day) and became less likely to be living in poverty ($2/day). On top of that, these families found themselves enjoying greater financial stability.

Half of Kenyans currently have bank accounts yet an incredible 96% of households have a mobile money account. This, coupled with the fact that there are over 110,000 mobile money agents while only 2,600 ATMs in place within Kenya underscores just how popular mobile money transfers have become here. In fact, you could call Kenya the shining success story of this type of digital payments system.

Conclusion

The success of M-PESA in Kenya and M-PAiSA in Fiji could inspire other countries in the Pacific region to place more focus and attention on developing a framework and policies that support and encourage the use of digital payment systems like mobile money transfers. Providing solutions to the unbanked and underbanked as alternatives to the traditional banking system can lead to increased wages, economic growth, and even jobs.

Embracing emerging technologies has been a boon for the prosperity of countries and people who adopt them. With these technologies quickly transforming the world, and with young people being able to easily adopt them and teach their families how to use them, it is time to see these novel digital payment systems adopted by more businesses and supported by government policies. The benefits are too significant to do otherwise.

If you are in the Pacific region and are interested in learning more about digital payment systems and how to leverage the benefits and integrate them into your business, you can contact us and begin the conversation.

About the Author

Paul Lenda is a Digital Advisor at Pacific Advisory. He has a decade of experience working and operating within the blockchain industry, and advises on the responsible use of emerging & digital technologies, as well as adoption of regenerative systems, in a way that leverages benefits, reduces risks, and optimizes processes, resulting in improved socio-economic models.